child tax credit september 2021 late

While taxpayers due a refund. WASHINGTON The Internal Revenue Service encourages taxpayers who missed Mondays April 18 tax-filing deadline to file as soon as possible.

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

Susan Tompor Detroit Free Press.

. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The IRS has confirmed that theyll soon allow claimants to adjust their. Children who are adopted can.

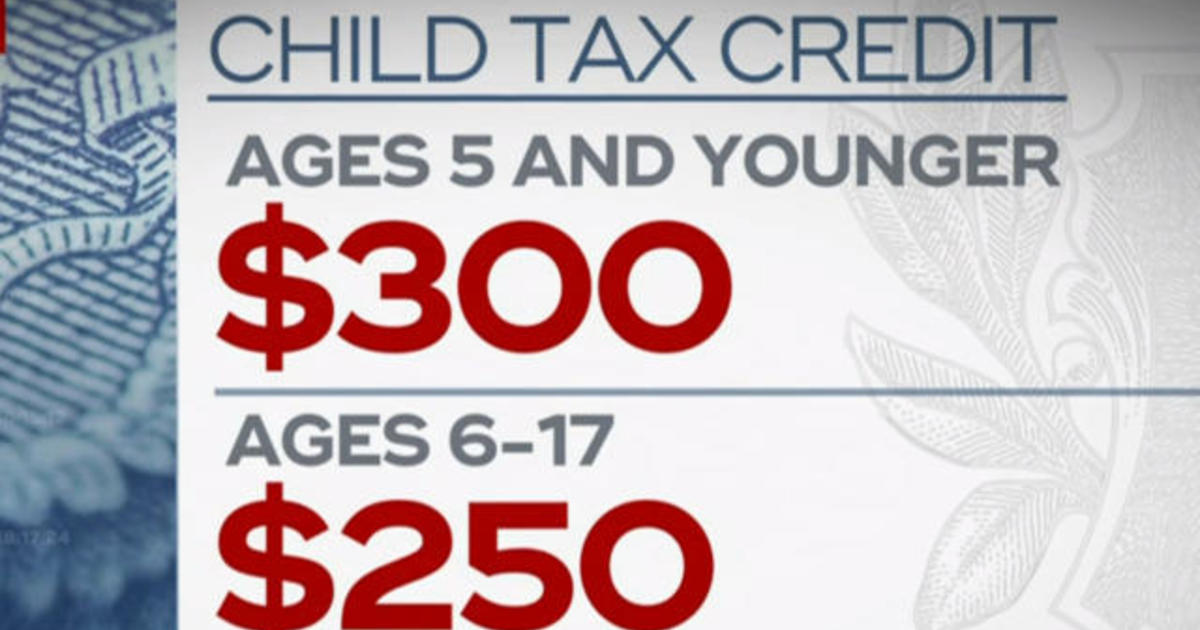

If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600. Chris Walker 37 a journalist in Madison Wisconsin told CBS MoneyWatch he was expecting a 250 Child Tax Credit payment for his 13-year-old son to land in his account by direct deposit on. The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18.

This isnt a problem to do. Children who are adopted can also qualify if theyre US citizens. Heres why your child tax credit payment might be late Lauren Verno Consumer investigative reporter Published.

Many parents continued to post their frustrations online Friday about not receiving their September payments yet for the. The second payment was sent out to families on August 13. So parents of a child under six receive 300 per.

The remaining money will come in one lump with tax refunds in 2021. September 18 2021 1128 AM 6 min read. September Advance Child Tax Credit Payments.

Children who are adopted can. 13 opt out by Aug. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600. However the payments will phase out by. 3600 for children ages 5 and under at the end of 2021.

3000 for children ages 6 through 17 at the end of 2021. The next round of Child Tax Credit advance payments are set to hit bank accounts on October 15. Taxpayers who owe and missed the April 18 filing deadline should file now to limit penalties and interest.

Those with kids between ages six and 17 will get 250 for every child. Get your advance payments total and number of qualifying children in your online account. August 17 2021 417 PM Updated.

August 17 2021 710 PM. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

For families who are signed up each payment is up to 300 per month for each child under age 6 and up to 250 per month for. This tax credit is changed. Families with kids under the age of six will receive 300 per child.

Children who are adopted can also qualify if theyre US citizens. Here is some important information to understand about this years Child Tax Credit. For families who received their first payment in September it may have been a larger amount of.

Children who are adopted can also qualify if theyre US citizens. The 500 nonrefundable Credit for Other Dependents amount has not changed. To get the full benefit single taxpayers must earn 75000 or less.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. If you have a baby anytime in 2021 your newborn will count toward the child tax credit payment of 3600. It also made the.

The Child Tax Credit provides money to support American families. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. Parents should have received the most recent check from the IRS last week for up to 300 per child.

To reconcile advance payments on your 2021 return. After the July and August payments the first two in the special 2021 child tax credit payment schedule were made on time the September one is taking longer for some. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The deadline for eligible families to opt out of receiving the 250 or 300 payment per eligible child is Monday October 4. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Four payments have been sent so far. IR-2022-91 April 19 2022. Enter your information on Schedule 8812 Form.

Child tax credit payments from September are finally hitting bank accounts as the IRS makes a new round of deposits on Friday. That drops to 3000 for each child ages six through 17. Not too late to claim the Child Tax Credit for 2021.

Children who are. IR-2021-188 September 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Property Taxes And Billings Bradford West Gwillimbury

Geoscan Search Results Fastlink

News And Events Mcca Early Childhood Education

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Canada Child Benefit Ccb Payment Dates Application 2022

Claim Of Gst Itc Of Previous Year If September Gst Return Filed Late Wit Previous Year September Tax Credits

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

Child Tax Credit 2021 Here S When The Fourth Check Will Deposit Cbs News

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

Missing A Child Tax Credit Payment Here S How To Track It Cnet

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

Opinion The Child Tax Credit Must Become Permanent And Refundable The Washington Post

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Canadian Tax News And Covid 19 Updates Archive

What To Know About September Child Tax Credit Payments Forbes Advisor